The Nigeria Deposit Insurance Corporation NDIC has listed the head office in Lagos and branches of failed Heritage Bank across the country for sale in its role as liquidator of the bank.

NDIC announced the sale of the bank properties numbering 48 and its chattel including vehicles, office equipment, plant, and machinery in another 62 locations across the country in an advertorial published in The PUNCH on Thursday.

“The Nigeria Deposit Insurance Corporation in the exercise of its right as Liquidator of failed Deposit Money Banks hereby invites interested members of the general public to buy the assets (landed property and chattels) of defunct Heritage Banks through public competitive bidding,” part of the advertorial read.

The head office of the bank and its annex located at 143 Ahmadu Bello Way and 130 Ahmadu Bello Way, Victoria Island, Lagos was listed for sale (buildings, chattels, generator, and motor vehicle). Also listed for sale were six other branches in Lagos, four branches in Abuja, four in Rivers States, and the others spread across the country.

Interested parties are invited to come for an inspection and subsequently put in bids on the assets to be submitted to the NDIC office in Lagos.

Bids are expected to come in with 10 per cent of the bid amount in Certified Bank Draft. Successful bidders will be required to pay the balance of the bid price within two weeks of notification.

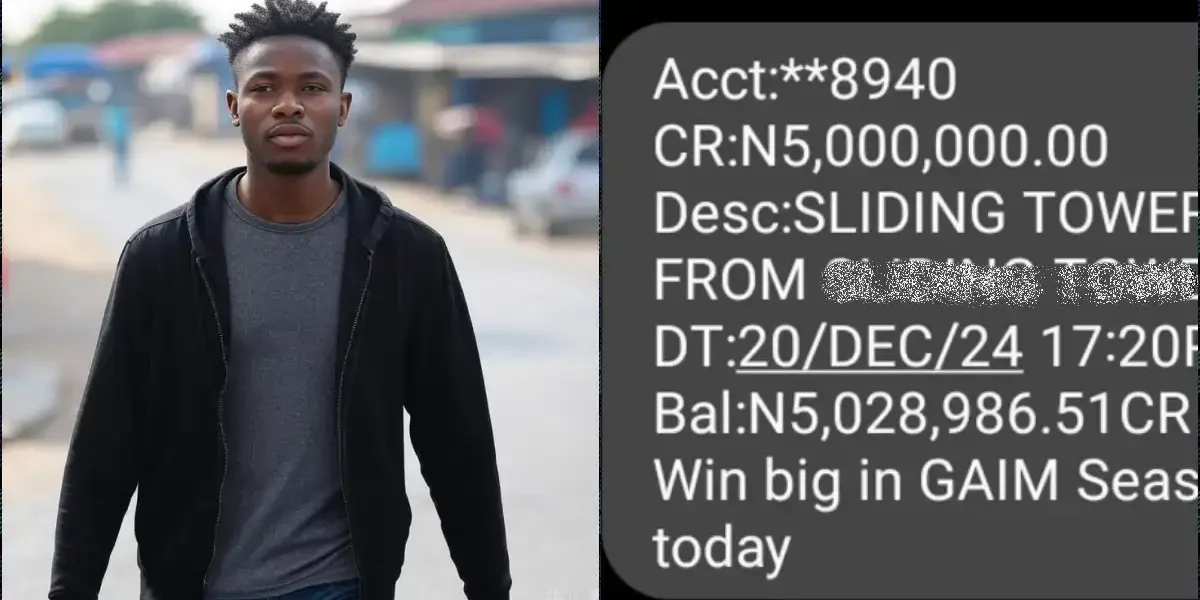

Earlier, the corporation announced the commencement of the verification and payment of the depositors of the bank with N5m or less in their accounts. This category of customers makes up about 99 per cent of the bank customers.

The Managing Director of the NDIC, Bello Hassan, at a media briefing on the liquidation of Heritage Bank in Abuja last Wednesday, put the total depositors at Heritage Bank at 2.3 million.

Hassan noted that the total bank deposits at Heritage Bank stood at N650bn while its loan portfolio was about N700bn

In announcing the revocation of the licence of Heritage Bank, the apex bank in a statement signed by the Acting Director of Corporate Communication, Sidi Ali, said, “This action has become necessary due to the bank’s breach of Section 12 (1) of BOFIA, 2020. The board and management of the bank have not been able to improve the bank’s financial performance, a situation which constitutes a threat to financial stability.

“This follows a period during which the CBN engaged with the bank and prescribed various supervisory steps intended to stem the decline. Regrettably, the bank has continued to suffer and has no reasonable prospects of recovery, thereby, making the revocation of the licence the next necessary step.”

Stakeholders in the sector have gone on to express confidence in the decision of the CBN in the overall interest of the sector.

The chairman of the Bank Directors Association of Nigeria, Mustapha Chike-Obi, in a chat with The PUNCH said,“BDAN accepts and respects the unique position of the CBN in making this kind of decision in the interest of the banking sector. BDAN is confident that CBN analysed all the pros and cons of this decision and took the best decision in the interest of the banking sector.”

Also, the House of Representatives has passed a resolution mandating the CBN to investigate the leadership and management of Heritage Bank to “Identify any possible issues of mismanagement or wrongdoing that may have contributed to the bank’s failure.”

This followed the adoption of a motion of urgent public importance during plenary on Tuesday, filed by the member representing Idemili North/Idemili South Federal Constituency of Anambra State, Uchenna Okonkwo.

It also urged the NDIC “to conduct a comprehensive review of its operations and the effectiveness of its mandate to ensure that it is adequately equipped and resourced to fulfill its role as deposit insurer and investor of failed banks.”