• CBN implements Deloitte FX audit report, EFCC may summon CEOs over $2.4bn invalid requests

• Several FX requests fraudulent, made with invalid, illegal documents, Cardoso insists

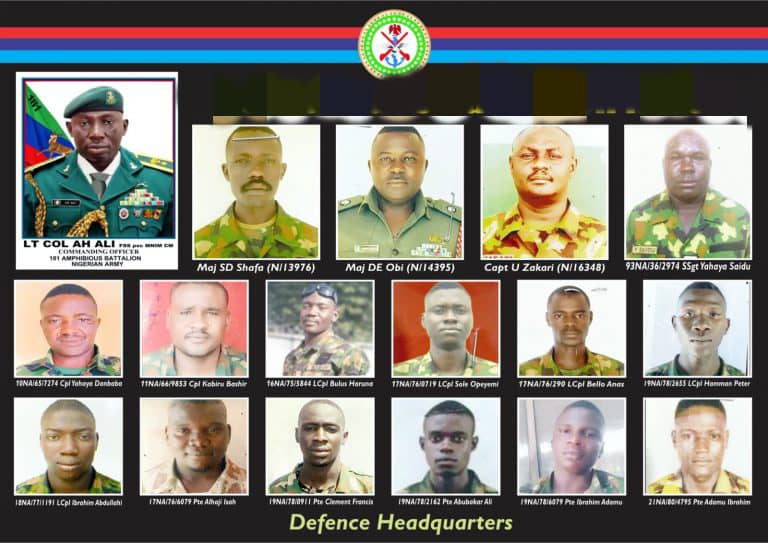

The Governor of the Central Bank of Nigeria, Olayemi Cardoso, has revealed that security agencies including the Economic and Financial Crimes Commission are currently investigating questionable foreign exchange allocations and forward contracts previously estimated at $2.4bn.

The development followed the conclusion of the audit of $7bn dollar debts inherited by the Cardoso-led CBN from the previous administration of the apex bank.

The new administration of the apex bank had engaged a global firm, Deloitte, to carry out an audit of the $7bn debts. Cardoso had earlier said about $2.4bn FX allocations from the $7bn backlogs were invalid.

Elaborating further on the issue while speaking with journalists shortly after the 294th meeting of the Monetary Policy Committee in Abuja on Tuesday, the CBN governor disclosed that security agencies were investigating the FX transactions that had been declared invalid by the audit report.

The apex bank, according to him, is providing the necessary documents to help the investigation.

Cardoso said law enforcement authorities were focused on unraveling issues around foreign exchange transactions that did not meet the standards of the regulatory agency

He stressed that the report of Deloitte consultants revealed that the majority of the transactions did not meet the criteria for payment.

He emphasised the lack of valid documentation, among other infractions and discrepancies revealed in the audit report.

The CBN chief detailed several anomalies, including the allocation of millions of dollars to fictitious entities, and the provision of FX allocations without the corresponding naira value.

While emphasising the gravity of the irregularities, Cardoso described the numerous foreign exchange transactions under investigation as “clearly unlawful.”

Cardoso explained, “Recall that when we came in September, we had a backlog of forward transactions which were contractual in nature and had already been contracted before we came in. It was clear to us that in the interest of the credibility of the central bank, which at that point in time was very much in question, we were able to satisfy and take care of these forwards.

“And I actually said it would be a priority to ensure that we take care of these forwards within the resource constraints we had. And that was why, on a regular basis, I tried to address the issue with the press and be transparent as possible to allow Nigerians to know exactly where we stood and what were doing.

“During that period we settled certain tranches and then we got wind of the fact that, well, there were a number of transactions which, quite frankly, had some issues with respect to the genuineness of them. That was how we brought in Deloitte management consultants who took their time; and this really did take months. This is not something that happened overnight.

Continuing, the former Lagos State commissioner of Finance stated, “It was determined that a number of these transactions did not qualify. In some cases, we have some allocations made in millions of dollars, which were never requested for; we also had somewhere they had no naira and they were also allocated some foreign exchange.

“It was for that reason that we refused to validate those particular transactions. Apart from the fact that documentation was not satisfactory, in many cases, they were outright illegal. The law enforcement agencies are now looking into those transactions that as far as we are concerned, are not valid to be paid.”

The CBN boss, however, noted that if findings later show some of the transactions can be cleared, the information will be made known

“I would emphasise that if there’s any information to the contrary, we would in due course consider that. But as of today, that is exactly where it stands and the law enforcement agencies are taking a very hard look at those transactions. I will say again, that the valid transactions as far as the Central Bank of Nigeria is concerned have been taken care of,” he noted.

The CBN had recently announced the complete clearance of the valid foreign exchange backlogs. This was after the apex bank cleared about $1.5bn.

The clearing of a significant part of the $7bn backlogs had helped to ease pressure on the naira which rebounded against the dollar at both the official and black market.

Cardoso said the major achievements were part of the decisive steps towards restoring confidence in Nigeria’s economy.

Similarly, he urged stakeholders to access the foreign exchange market to settle their forex transactions, adding that the bank would always maintain an open, transparent, and liquid market for economic prosperity.

However, the ongoing probe may force operatives of security agencies to invite some bank chiefs as well as the chief executive officers of some banks. It is still unclear how long the investigation will last.

Meanwhile, some members of the organised private sector had opposed the rejection of their forex exchange bids by the central bank.

Some businesses under the aegis of the Organised Private Sector of Nigeria said they were considering taking legal action against some commercial banks for not honouring forex requests which have lingered over an extended period.

Some of the member associations, speaking in separate interviews, faulted the process through which the CBN conducted the settlement of the backlogs. They argued that the process was not transparent, neither was it carried out in the interest of full disclosure.

The threat of litigation came despite a recent stakeholder meeting comprising some members of the OPSN, the affected banks and customers which was convened by the Minister of Industry Trade and Investment at the Bank of Industry in Lagos on March 21, 2024.

The National Vice President of the Nigerian Association of Small Scale Industrialists, Segun Kuti-George, had on Sunday said, “Some of the requests have been cleared, but there are others that they are saying were illegal and did not meet their criteria, but the importers are not aware of the reason why the requests have been rejected. Their monies are still with the bank, and they are groaning.

Also, the National President of the National Association of Chambers of Commerce, Industry, Mines, and Agriculture, Dele Oye, had called on the CBN and the Ministry of Trade and Industry to craft an urgent solution to the unmet forex requests by some members of the OPSN to avert what appears to be a looming legal action on the part of the affected businesses.

According to Oye, several NACCIMA member companies and other private sector operators have challenged the completeness of the forex clearance.

Cardoso reacts

But responding to issues of some stakeholders who have backlogs of forex, Cardoso assured that the market remains open and transparent for them to address any outstanding contractual obligations. However, he said the CBN had diligently verified and settled recognised backlogs of forward transactions.

“We are also not unmindful of the fact that some stakeholders may have had backlogs in one form or the other. We have done what we can to make the market transparent as much as possible. Those involved should patronise the open market,” he said.

On enforcement issues regarding the crypto market, the CBN governor said he was working with various agencies to enforce the law noting however that the Security and Exchange Commission, not the CBN, regulates the cryptocurrency market

The CBN governor reiterated that the fertiliser donation to farmers through the Ministry of Food Security and Agriculture does not mean the bank has resumed direct interventions.

“We have been consistent in saying that we will withdraw from direct intervention. We have been consistent in saying so. We have also been consistent in saying that we will work with those who we believe have the capacity to successfully intervene in whatever manner they can.

“The fertilizers given out were the residue of an intervention that had been done before we came into office. It was not something that was done directly by us. And the options were either to leave them there to rot away or to give them to those that we believed had the capacity to distribute. And that is exactly what we did with the handing over to the Ministry of Agriculture. Does this suggest a return to developmental interventions? And the answer is no, it doesn’t. In actual fact, we’ve taken those particular merchandises and put it where it rightly belongs.”

Meanwhile, the apex bank has directed deposit money banks in the country to expedite actions on the increase of their capital base in order to strengthen the financial system against potential risk.

Cardoso stated that the MPC examined developments in the banking sector and expressed satisfaction that the industry remained stable, safe, and sound.

Recall that in November 2023, Cardoso at the 58th Annual Bankers’ Dinner organised by the Chartered Institute of Bankers of Nigeria announced plans by the apex bank to carry out a fresh round of banking recapitalisation for the Deposit Money Banks.

He said the policy was part of its efforts to strengthen its capacity to support Nigeria’s drive to become a $1tn economy by 2026.

The current capital base is stratified based on the type of banking license – banks with regional, national, and international licenses are currently expected to maintain a minimum capital base of N10bn, N25bn, and N50bn, respectively.

The proposed increase in the capital base is coming nearly two decades after the CBN’s 2004 banking reform, which led to an increase of the then prevailing capital base from N2bn to N25bn.

However, the committee in its meeting noted that to guard against risk, commercial banks in the country should accelerate their recapitalisation efforts.

Cardoso said, “The MPC also reviewed developments in the banking system and noted that the industry remains safe, sound, and stable. The committee thus called on the bank to sustain its surveillance and ensure compliance of banks with existing regulatory and macro-potential guidelines.

“The MPC also enjoined the banks to expedite actions on the recapitalisation of banks to strengthen the system against potential risks in an increasingly globalised world.”

Naira now 1,382/dollar

Meanwhile, the Nigeria local currency has continued its surge against the United States dollar, appreciating to N1,382/$ on Tuesday from N1,420/$ recorded on Monday.

The new rate according to FMDQ Securities Exchange, a platform that publishes official foreign exchange trading in the country, means the naira gained N38 or 2.75 per cent at the close of trading activity.

In the last one month, the naira has strengthened by 20.4 per cent to N1,382 on Tuesday from the lowest of N1,665.50 closed on February 23, 2024.

The naira has been appreciating against the dollar recently following some foreign exchange reforms by the Central Bank of Nigeria.

At the press briefing that followed the 294th Monetary Policy Committee meeting, the governor of the Central Bank, Olayemi Cardoso, noted the improvement in foreign exchange, stating that forex stability will enhance investor confidence and attract foreign investments to Nigeria.

He said, “The considerations of the Committee at this meeting focused on the current inflationary pressures and the need to anchor inflation expectations as well as ensure sustained exchange rate stability.

“The Committee noted with satisfaction the level of stability achieved in the foreign exchange market in the last few weeks. This, in the view of Members reflects the impact of the Bank’s recent policy actions and reforms, as well as increased transparency in the market. In addition, the Committee noted the efforts of the Bank in offsetting verified foreign currency obligations, an action that will greatly enhance investor confidence and attract foreign investments to Nigeria.”

The summary of the daily FX market trading showed that the intraday high closed at N1,486 per dollar. The intraday low closed flat at N1,300per dollar on Tuesday, while the official FX market recorded a turnover of $245.58m.

Despite this gain, the prices of attendant goods and services have not reduced. In Nigeria, where the economy is significantly import-dependent, a weaker Naira makes imported goods more expensive, thereby fueling inflation.

PUNCHNG